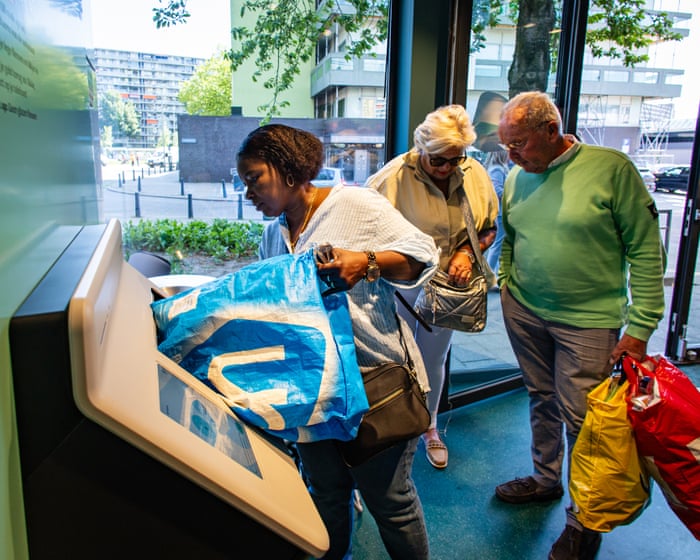

When Mariama Kamara walks into the new bottle return shop on Nieuwezijds Voorburgwal, she has a clear goal. Her aunt, who owns a nearby restaurant, has sent her to return three large blue bags full of bottles and cans. In just seven minutes, she feeds around 350 cans into the deposit machine, earning over €50 (£43) that will go straight back into her aunt’s business. “It’s a great idea and super convenient,” she says.

In the Netherlands, shoppers pay a small deposit (called statiegeld) when buying drinks in cans, glass, or plastic bottles—ranging from 15 to 25 cents depending on size and material. This deposit can be refunded by returning the empty containers to a “reverse vending machine.” Any unclaimed deposits help fund and expand the recycling program.

However, these machines—usually found in supermarkets to catch shoppers—aren’t always reliable or spacious enough. Stores also only accept packaging from brands they sell. For example, Lidl won’t take a Coca-Cola bottle because they don’t stock it. Unlike many other countries with deposit schemes, Dutch law doesn’t require non-supermarket stores to have these machines.

The Netherlands has set an ambitious national target under its packaging regulations: beverage companies must recover at least 90% of all bottles and cans sold. But progress has been slow. Last year, 77% of plastic bottles and 84% of cans were returned—high compared to many countries, but still short of the goal.

To bridge the gap, Verpact (the organization managing the system) is testing dedicated return shops. The first opened in Rotterdam in May, equipped with a high-capacity machine that can process up to 200 containers at once. Since then, over a million items have been returned.

Amsterdam now has two of these shops, both in central locations, attracting a steady stream of users—locals, businesses, tourists, and even people who spend evenings collecting cans and bottles. “For some, it’s trash. For others, it’s a meal,” says an employee from Kier, the group running the shops.

Deposit systems aren’t new. British Columbia launched the first mandatory program for beer and soda containers in 1970, followed by Sweden in 1984—the first in Europe. The Netherlands introduced its scheme in 2006, gradually expanding it. Today, 17 European countries, including Norway, Germany, and Ireland, have similar programs. Recent EU laws now require member states to hit a 90% collection rate for single-use plastic bottles and cans, pushing more countries to adopt such systems.

Hester Klein Lankhorst, CEO of Verpact, sees these return shops as crucial for meeting the tight deadlines: “The targets are extremely high, and we have to act fast.”

Under Dutch law, companies selling packaged goods must manage collection and recycling, including the deposit system. Verpact, representing the packaging industry, submits annual progress reports to the government.

Returned containers are sorted and recycled, keeping waste out of landfills and reducing environmental harm.The collected bottles are primarily processed into new raw materials that can be sold back to manufacturers. According to Verpact, recycled PET (polyethylene terephthalate) is used to make new PET bottles. In 2023, PET bottles already contained an average of 44% recycled material. The Netherlands has also set a requirement that by 2025, at least 25% of each PET bottle must be made from recycled content.

Deposit return schemes are seen as a way to promote a circular economy and, in some cases, help reduce litter. A study by the Dutch Ministry of Infrastructure and Water Management, along with CE Delft and Utrecht University, found that since the introduction of return points (though they may not be the sole reason), litter from small plastic bottles and cans decreased by 69%.

However, there are downsides. In some areas, people searching for bottles to redeem for cash may rummage through trash bins, sometimes worsening litter problems. “In certain cities, especially near garbage bins, litter has increased, creating additional cleanup costs as broken cans attract animals,” says Martin Calisto Friant of Circle Economy, an Amsterdam-based nonprofit.

Managing the technology and transportation for these systems is costly. “It’s an expensive system, but it does help reduce litter,” says Lankhorst. Another concern is whether the financial incentive—a key driver for recycling—is strong enough. “The deposit value for small containers is too low, which I see as a major flaw in the Dutch system,” says Thomas Morgenstern of Tomra, a Norwegian company that supplies reverse vending machines for many Dutch deposit schemes.

An automated bottle return site in the Netherlands.

The low deposit may not encourage people to consume less, which Calisto Friant believes is the bigger issue. It’s also unclear whether these systems actually reduce plastic production. “A higher deposit could be a useful incentive to cut down on single-use packaging, which should be the priority,” he says.

Ideally, every store would have fully functional recycling units, say Lankhorst and Verpact. For now, the deposit return shops serve as a practical solution to reduce litter and meet legal targets.

“There’s no perfect fix,” Lankhorst says. “But together, we can make it easier for people to get their deposit back and dispose of bottles and cans properly.”

For Kamara, the system is more convenient. She used to manually insert bottles one by one at supermarkets—a tedious task. “Doing it all by hand would hurt my back,” she says.