Nvidia, the world’s top chipmaker, has announced a $5 billion investment in Intel and a partnership with the struggling semiconductor company to collaborate on new products.

This comes one month after the Trump administration confirmed it had taken a 10% stake in Intel—the latest in a series of unusual White House interventions in corporate America. Nvidia stated it will work with Intel to develop custom data centers, which are essential for artificial intelligence (AI) infrastructure, as well as personal computer products.

Intel’s stock jumped 29% in pre-market trading in New York, while Nvidia’s shares rose nearly 3%, boosting its market value to over $4 trillion.

Nvidia plans to spend $5 billion to purchase Intel common stock at $23.28 per share, pending regulatory approval.

Nvidia CEO Jensen Huang described the partnership as “a historic collaboration” that brings together Nvidia’s AI and accelerated computing capabilities with Intel’s CPUs and the broad x86 ecosystem. “Together, we will expand our ecosystems and lay the foundation for the next era of computing,” he said.

The two companies aim to seamlessly integrate their architectures. For data centers, Intel will produce custom chips for use in Nvidia’s AI infrastructure platforms, while for PCs, Intel will build chips that incorporate Nvidia’s technology.

This deal offers a crucial lifeline for Intel. Once a Silicon Valley pioneer that thrived for decades by powering the personal computer revolution, the company struggled after missing the shift to mobile computing following the iPhone’s 2007 debut.

Intel fell further behind in recent years as the AI boom propelled Nvidia to become the world’s most valuable company. Intel reported a loss of nearly $19 billion last year and an additional $3.7 billion in the first half of this year. It also plans to reduce its workforce by a quarter by the end of 2025.

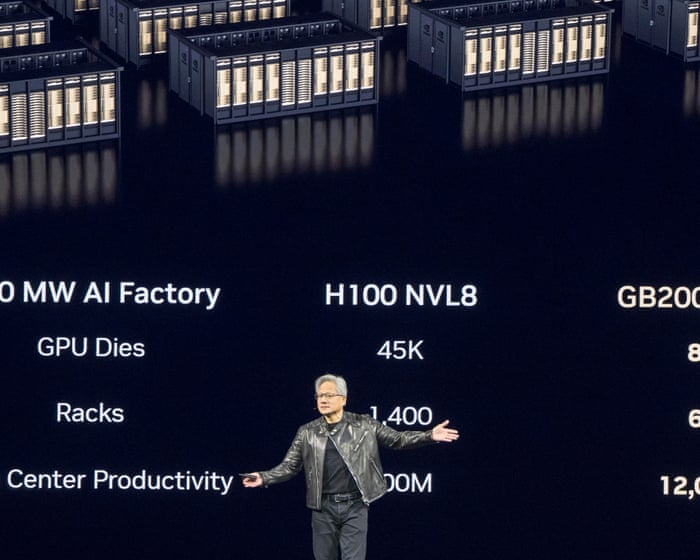

In contrast, Nvidia has surged due to the high demand for its specialized chips, known as graphics processing units (GPUs), which are highly effective for developing advanced AI systems.

Dan Ives, a tech analyst at Wedbush, commented: “With AI infrastructure investments expected to reach $3 to $4 trillion by the end of the decade, the chip landscape remains Nvidia’s world. Everyone else is just paying rent, as more governments and companies line up for the most advanced chips available.”

Reporting contributed by the Associated Press.

Frequently Asked Questions

Of course Here is a list of FAQs about the topic designed to be clear and helpful for a range of readers

General Beginner Questions

Q What is the main news here

A The news is that the graphics chip company Nvidia plans to invest 5 billion in the semiconductor giant Intel This follows the US government under the Trump administration taking a 10 ownership stake in Intel

Q Why would Nvidia invest in Intel a competitor

A While they compete in some areas they are also deeply interconnected Intel manufactures chips and Nvidia designs them A stronger Intel especially its manufacturing division could be beneficial for Nvidias supply chain and US tech leadership as a whole

Q Why did the US government get involved and buy a stake in Intel

A The primary reason is national security and economic strategy The US wants to reduce its reliance on foreign countries for advanced computer chip manufacturing Investing in Intel a leading American chipmaker helps bolster domestic production

Advanced Strategic Questions

Q Is this a bailout for Intel

A Not exactly a bailout in the traditional sense Intel has faced manufacturing delays and increased competition This investment is more of a strategic partnership and a massive vote of confidence from both a key industry player and the US government to help Intel regain its leadership

Q What does Nvidia get out of this 5 billion investment

A Nvidia likely secures a more stable and advanced manufacturing partner for its future chips It also gains a financial stake in a competitors success and aligns itself with US industrial policy which could be favorable for future contracts and regulations

Q How does the governments 10 stake work Is it a takeover

A No its not a takeover A 10 stake makes the US government a significant minority shareholder This gives them a seat at the table to influence strategic decisions particularly those related to expanding USbased manufacturing facilities without taking over daily operations

Q Will this impact the global semiconductor market

A Absolutely This move significantly strengthens the US position in the global chip race against other regions like East Asia and Europe It could