Hamish Wilson lives a few miles from me in a cozy farmhouse nestled in the damp hills of mid-Wales. He brews excellent coffee, tells captivating stories, and is a wonderful host. Every summer, dozens of Somali guests visit Wilson’s farm as part of a heartwarming project. It was created to celebrate their nation’s culture and to honor his father’s World War II service alongside a Somali comrade.

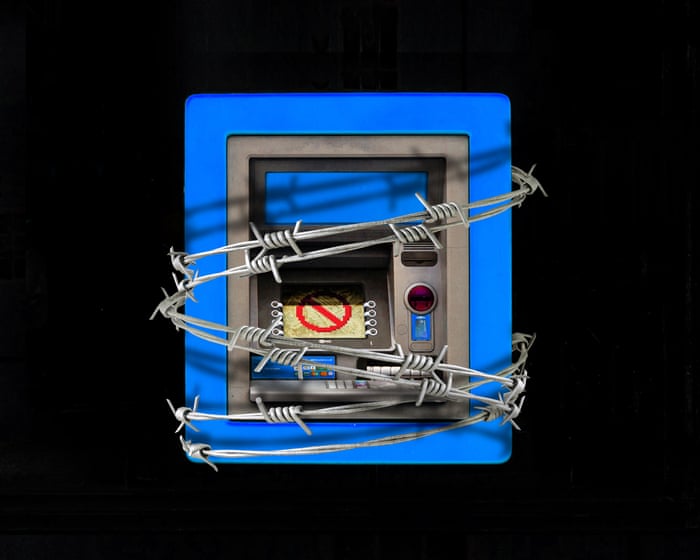

Yet, this project has unintentionally highlighted something else: a profound unfairness in today’s global financial system. This unfairness not only threatens to disrupt the Somalis’ holidays but also excludes marginalized communities from essential banking services on a massive scale.

The story begins in 1940, when a 27-year-old Captain Eric Wilson led a desperate stand against an Italian invasion of the British colony of Somaliland. Suffering from malaria, vastly outnumbered, and under heavy artillery fire, Wilson and a small band of Somali comrades—like the Spartans at Thermopylae, but in khaki shorts—held off the Italians for an astonishing five days.

After their position was overrun, Eric was presumed dead and was awarded a posthumous Victoria Cross. This came as quite a surprise when he was freed from a prisoner-of-war camp months later. It was an extraordinary honor, the highest a British soldier can receive, but it always troubled him. Why had he been recognized, while his sergeant—an old friend named Omar Kujoog who died in the battle—received nothing?

Wilson, my neighbor in Wales, inherited his father’s passion for East Africa and spends much time there himself. He and his friends, including Kujoog’s son and grandchildren, grew increasingly concerned that young Somalis in the UK were losing touch with their traditions, learning about their homeland only through the media’s negative portrayals.

So, before Eric’s death in 2010, they sold the Victoria Cross and bought the farm to create a center for Somalis to learn about their culture and to commemorate the bond between the Wilson and Kujoog families. They named it Degmo, the Somali word for a nomadic herders’ encampment.

Every summer, groups come to stay, each contributing a bit of money to a charity Wilson set up to cover costs. His Somali visitors camp in gleaming bell tents and dine in dome-shaped pavilions. Wilson organizes farm activities—children round up sheep, walk through the woods, and gaze at the stars looking for meteorites—while Somali elders impress their grandchildren by effortlessly milking goats or moving livestock, finding a new audience for stories of Somalia in their youth.

It’s a lovely project, and in some ways, not particularly unusual. Farmers often earn extra income by hosting city-bred campers. What is unusual, however, are the problems Wilson faces with his bank. “They phone me up and say, ‘I need to ask you some questions about your account,'” Wilson told me. “They go through the charity account and ask about the source of every single deposit or withdrawal. Every time they ask the same questions, and I say, ‘Well, look, I told you this two or three weeks ago,’ and it’s always another half-hour of my time.”

His troubles pale in comparison to those of his guests. One community leader from Birmingham—with her daughter along to help translate some of the more technical terms—told me how difficult it was to bring a few dozen Somalis to the countryside for a weekend. The drive is only two hours, so the logistics are simple, but the finances were a nightmare. She assumed paying Wilson for food and lodging would be easy. Others would transfer money to her account, and she would then pass it on, allowing her to keep track of who had paid.She was paid about £4,000, which moved through her account between July and September the previous year. That’s when the problems began. Bank compliance officers called her in for meetings and scrutinized every transaction, demanding to know who was sending her money, how long she had known them, and where the funds came from. “It almost made me feel like we were doing something wrong, like we were money laundering,” she said, disbelief in her voice.

And that was only the beginning. She had planned a trip to Somalia to visit relatives and transferred money to her sister so they could buy plane tickets together, but the bank froze the funds, making it impossible to purchase anything. She started a savings club with friends, where each would contribute £200 a month and withdraw £2,400 once a year, but the bank froze that account too.

The smallest things raised the bank’s suspicions. If she wrote a payment reference in Somali instead of English for an online transfer, the transaction was blocked. If she moved more than £250 at once, the payment was halted until she explained the source of the money.

“A lot of people in our community are struggling with this, but they prefer to leave it alone. The worry is that if you complain, there will be even more questions,” said the Birmingham community leader. “The days I have to go to the bank are the worst. I never want to go to the bank.”

Like most people who holiday in this part of Wales, the campers are British citizens; they live in the UK and use British bank accounts. So, what exactly sets the people visiting Wilson’s farm apart from campers at other farms?

“It doesn’t matter that I’m a British citizen—it’s just that I’m poor, and there’s this,” said the community leader, tracing a circle around the edges of her hijab with her finger before giving a shrug and a rueful smile.

The uncomfortable truth is that, unlike most campers in this area, the community leader and her friends are Black and Muslim. And Black Muslims are among the primary victims of a system established after the September 11, 2001, attacks to prevent terrorists from moving money. This system has failed to achieve its main goal—terrorists remain just as widespread today as they were two decades ago—while making life much harder for millions of innocent people.

After 9/11, officials wanted access to every tool that could help save lives, and they believed tracking financial movements might be one of them. Within days, the UN Security Council demanded that all countries establish systems to freeze terrorists’ assets. In October 2001, U.S. President George W. Bush signed the USA PATRIOT Act, which expanded anti-money laundering rules to cover terrorists. That same month, the Financial Action Task Force (FATF)—an intergovernmental body created in 1989 to develop a global approach to money laundering—published recommendations for a “basic framework to detect, prevent, and suppress the financing of terrorism and terrorist acts.”

The FATF was created during the height of the “war on drugs” to stop criminals from hiding their profits. Throughout the 1990s, it persuaded, pressured, and coaxed countries worldwide to adopt common standards for regulating the financial system. Its main tool was requiring professionals to report suspicious transactions to authorities, enabling governments to stop illicit money at its source, with heavy fines and criminal prosecution for non-compliance.

On one level, since the FATF specialized in tracking illicit money, it made sense to use its expertise against terrorist financing. On another level, it made no sense at all.Money launderers take large sums of illegal cash and filter it through the financial system to make it appear legitimate. In contrast, terrorists take small amounts of legal money and, by using it to fund violence, turn it into criminal funds. Why should the mechanisms designed to catch one also be expected to detect the other?

There was another issue: terrorists’ money only becomes criminal after they commit their attacks. For banks to block it beforehand, they would need insight into something impossible to know—their customers’ future plans. Without that knowledge, they wouldn’t know what to look for. Richard Gordon, a lawyer who worked for the International Monetary Fund at the time, says he tried to warn participants they were moving too quickly. “To say that banks have to figure out on their own what’s terrorism finance, that’s lunacy, and I said that too. Didn’t matter, I was overruled,” he told me.

So the FATF’s proposals were adopted. No banker wanted to be caught moving money for terrorists, partly because they were horrified by 9/11, but also because the consequences for them and their employers would be severe. In 2004, family members of victims of a Hamas attack in Israel sued Jordan’s Arab Bank in a U.S. court, alleging that by holding accounts for members of the group, the bank had assisted in the murders. The case was settled with a large payout, even though Hamas was not illegal in Jordan. Arab Bank warned that the case “exposes the banking industry to enormous liability for nothing other than the processing of routine transactions and the provision of conventional account services even if all governmental requirements are followed.”

Banks were in a difficult position. They had no idea what terrorist fundraising looked like, yet faced huge fines if found complicit. Desperate compliance officers searched official documents for any clues, and in FATF guidance from 2002, they found a useful hint: “Often such fundraising is carried out in the name of organizations having the status of a charitable or relief organization, and it may be targeted at a particular community.”

While it’s true that some charities or non-profit organizations (NPOs) have been used to raise funds for terrorist groups, so have businesses, criminal gangs, wealthy individuals, and others. But that didn’t matter; banks now had something specific to watch for: a “charitable or relief organization… targeted at a particular community.” That signal was clear enough for even the most cautious compliance officer to hear.

In the decades since, humanitarian, charitable, and cultural organizations run by Muslims, focusing on Muslim beneficiaries, or working in Islamic countries have had their bank accounts closed—often called “debanking” or “de-risking”—to an astonishing degree. This has happened worldwide, including in Muslim-majority countries, where bankers are just as worried about fines as their counterparts in Europe or North America, if not more so. And it receives almost no attention.

A 2022 poll in the U.S. showed that over a quarter of Muslim respondents reported banking problems, such as being denied an account or having one suspended—more than three times the rate for White evangelicals. While others typically cited credit scores or overdrafts as reasons, Muslims reported being cut off due to international transactions, sending or receiving funds from unfamiliar people, or being flagged for “a key word.”

That last point seems to explain what happened in July 2014 in the UK, when HSBC wroOn the same day, HSBC notified a group of Muslim-focused nonprofit organizations that their bank accounts would be closed. The Finsbury Park mosque in London, the Cordoba Foundation think tank, the Ummah Welfare Trust, and others all received identical letters stating: “I am writing to inform you that HSBC Bank has recently conducted a general review of its portfolio of customers and has concluded that provision of banking services … now falls outside of our risk appetite.” The letters continued, “I am sorry we are unable to continue to provide you with banking services, but do thank you for your custom to date.” There was no chance to appeal, no explanation, and no warning—just two months to find a new bank.

And that was just one bank. In 2016, the Co-operative Bank cut off Friends of Al-Aqsa, the Palestine Solidarity Campaign, and 25 other pro-Palestinian groups. Four years earlier, Islamic Relief Worldwide, Britain’s largest Muslim nonprofit, operating in over 30 countries, was blocked by UBS. Walid Safour of the Al-Amal Foundation, formerly of Human Care Syria, lost his personal bank account—as did his spouse and all his fellow trustees—without any explanation.

This pattern repeats globally. In 2006, FBI agents raided a Muslim-run humanitarian organization in Michigan. No charges were ever filed, but it lost its accounts. In 2019, a Canadian nonprofit was cut off after a manager was charged with terrorism offenses in Pakistan. The manager was acquitted, but the organization still lost its bank account.

This is more than an inconvenience. Charities depend on regular donations to operate, and if accounts are closed, donors must set up payments again—something many fail to do. The stigma also spreads, making the problem persistent. “Once you’re flagged, it’s very difficult to find another bank that will be willing to do business with you,” one nonprofit director told researchers for a U.S. report on debanking.

The director spoke anonymously, as do almost all those affected by this issue—notice that in this article, almost no one is quoted by name. “This is fundamentally a story about shame. It is shame that has kept this story shrouded in obscurity so long,” wrote the author of a report by the National Council of Canadian Muslims, which quoted representatives from five different nonprofits. “They all asked to be anonymous for this report. That’s because the shame and social stigma of getting ‘debanked’ remains to this day.”

I do not underestimate the importance of fighting terrorism. I spent years reporting on atrocities committed by militants fighting for an independent Chechnya. I saw the huddled bodies of young people murdered outside a concert, scraps of flesh in the snow after a suicide bombing, and rows of dead children whose only crime was going to school on the wrong day. A good friend died in a bombing, and I still miss him. Terrorism is grotesque. But you don’t fight terrorism by ostracizing blameless people or alienating entire segments of the population.

“Can we speak of racism here?” asked Mohamed Ibrahim, director of the London Somali Youth Forum. Banks vigorously deny targeting Muslims specifically because they are Muslim, and I believe they are telling the truth. So what is the mechanism behind this?

I believe it stems from compliance systems that rely on databases gathering media publications worldwide to search for “adverse news.” If negative stories appear about you, you might be considered a terrorist risk, and banks, fearing prosecution, may debank you.

Muslim names are distinctive and often shared by many individuals. It’s not hard to imagine that searching for someoneSearching a name in a database can bring up multiple news reports. In such cases, a bank may have no way of knowing whether the individual mentioned is their client or someone else, but might close the account anyway rather than take the risk. One researcher shared an example where an organization was flagged simply because it was located in the same office building as a mosque. Despite being completely unrelated and three floors apart, sharing an address was enough to raise suspicion.

In 2007, the Financial Action Task Force (FATF) attempted to address this by introducing a “risk-based approach,” directing financial institutions to focus on individual account holders rather than broad categories of people. For instance, banks should not close an account just because an organization has “Syria” in its name, but only if it actually supports terrorist groups in Syria. However, fourteen years later, the FATF criticized banks in a report titled Unintended Consequences for failing to follow this guidance, stating that widespread account closures are “by definition inconsistent with a proper application of the risk-based approach.”

This report stands out as particularly misguided among many I’ve encountered. Not only was it two decades too late, but it also drew entirely the wrong conclusion. When you instruct people to do something and they consistently do the opposite, it would be wise to consider whether the fault lies with the original instruction rather than everyone’s interpretation of it.

The FATF should have started by examining the word “risk” and what it means to different parties. For the FATF, the risk is about the movement of illicit funds, whether from criminals or terrorists. But for financial institutions, the risk is about facing fines. This makes perfect sense: banks are profit-driven businesses, and anything threatening their profits is a legitimate concern. While banks may claim to care about stopping dirty money, in reality, they care about avoiding financial losses. Viewing the post-9/11 financial framework from this perspective makes everything clear.

In short, banks have been asked to take on a policing role, but they are refusing because it is costly. One European bank told researchers from the Norwegian Refugee Council that checking just one client’s attempt to send funds to Afghanistan required 40 to 50 employees. How long would any business continue such efforts before deciding it isn’t worth it? If maintaining a single account demands dozens of compliance officers and carries the risk of billion-dollar fines for any misstep, closing it is a rational decision. As Pamela Dearden, managing director for financial crimes enforcement at JPMorgan Chase, put it: “We are kind of in a ping-pong match between financial inclusion and avoiding regulatory scrutiny, and we are the ball.”

Between 2016 and 2022, the number of accounts closed annually in the UK rose from 45,091 to 343,350, a trend likely mirrored in other countries. While bankers likely don’t make these decisions lightly, their priority remains protecting the bank, not its customers.

A British parliamentary report highlighted a small company that built solar-powered water pumps in India for African customers, with support from the UK and US governments. In 2020, its bank announced it would close the company’s account without explanation. The company’s leaders suspected the bank was concerned about receiving funds from Nigeria, which is considered high-risk for money laundering and terrorism. They tried to clarify the situation but found it nearly impossible. As the CEO described, “It was like dealing with a black hole. The bank didn’t want to listen and, seemingly, didn’t care.””It felt very automatic. Computer says no. It was a very scary time.”

When the company tried to open a new account elsewhere, banks refused as soon as they heard why it needed one. In desperation, the CEO asked his MP to contact the bank’s chief executive, who abruptly—and again without explanation—reversed the decision and allowed the account to stay open.

The whole situation feels capricious. Decisions are made by anonymous compliance officers based on unknown information, unless you’re lucky enough to find someone who can overturn them, again with no clear logic.

It hardly needs saying, but this post-9/11 system has failed. The campaign to cut off terrorist funding didn’t stop them; militant groups have spread across much of the Middle East, central Africa, and elsewhere. The Taliban are back in control of Afghanistan.

For years, campaigners have tried to explain that this system causes immense harm without doing much good. Interventions by the Financial Action Task Force have failed, not for lack of good intentions, but because they don’t address the core problem.

This is, above all, a political failure. Asking profit-driven banks to act as a police force is inherently corrupting. Civilized countries don’t use bounty hunters for a reason: if the bounty is too low, the crime goes unsolved; if a defendant is rich, they buy their freedom and the crime still goes unsolved. By tasking banks with policing terrorist financing, we end up harming the poorest—who can’t pay their way out—while letting the richest off the hook. Banks face fines if caught breaking rules, but they simply adjust their fees to cover the cost.

Unlike a proper justice system, there’s no appeal against a bank’s decision. Some who’ve lost accounts have sued for discrimination and won small compensations in isolated cases. But generally, banks have no obligation to keep a customer. As long as they comply with the account terms, they can do as they please.

For those who lose their account, there’s one option left—but it’s only for a select few.

In November 2022, Coutts—a UK private bank serving the very wealthy—decided through its “wealth reputational risk committee” to close Nigel Farage’s account. Internal documents showed the bank considered him “significantly loss-making,” but also that his divisive political views might threaten its reputation.

Farage didn’t take it well. In June 2023, he went public, accusing the bank of punishing him for his beliefs—a claim the bank struggled to deny, since the documents did show his politics were a factor.

His allies in media and politics framed it as financial “cancel culture” and pressured Coutts into reversing its decision. It was a telling episode. Politicians and journalists treated it as an isolated, troubling incident demanding immediate intervention. They seemed unaware that banks routinely close accounts based on who customers are. What happened to Farage was exactly what British Muslims have faced for decades. The difference was that he had high-profile allies who raised questions in Parliament and wrote press articles that embarrassed his bankers into backing down.Nigel Farage had his bank account closed by Coutts in 2022, though the bank later reversed its decision.

A similar situation happened in the U.S. after the Treasury Department started an anti-fraud effort called Operation Choke Point in 2013. Following major financial scandals like those involving Bernie Madoff and Allen Stanford, officials wanted to prevent banks from handling fraudulent funds. They focused on key points in the financial system, especially payment processors that handle transactions for businesses. This approach was consistent with long-standing anti-money laundering practices, but it faced opposition from some bank lobbyists and was given an ominous-sounding name.

Those lobbyists, seeking to fight the operation, found a document listing client types that banks should consider high-risk. While most entries made sense—such as escort services or Ponzi schemes—the list also included “firearms and ammunition manufacturers and retailers,” which provided an opening. Critics portrayed the operation as a political attack by the Obama administration on the constitutional right to bear arms. Texas congressman Roger Williams called it “an affront to the freedoms and liberty that millions of Americans have died to protect” and “one of the most abusive government overreaches in our nation’s history.” Despite efforts by officials and commentators to clarify that the operation was routine, that no gun shops were involved, and that banks were simply asked to do normal risk assessments, the opposition succeeded, and the operation was canceled in 2015.

The success of this opposition meant that when cryptocurrency companies later lost their bank accounts, their supporters used similar tactics against the Biden administration, calling it “Choke Point 2.0.” They claimed the White House was using back channels to shield big banks from competition. This was unfounded. There were legitimate concerns that crypto firms were enabling money laundering and fraud, as many had done exactly that. Still, the idea that this was a politically motivated attack spread through right-wing media and became widely accepted.

In a November interview on the Joe Rogan podcast, billionaire venture capitalist Marc Andreessen, a vocal supporter of Donald Trump’s 2024 campaign, argued, “Basically, it’s a privatised sanctions regime that lets bureaucrats do to American citizens the same thing that we do to Iran.” He claimed this was happening to fintech entrepreneurs trying to start new banking services to protect big banks. Andreessen suggested the Treasury Secretary could simply call a bank and demand a political opponent be removed from the financial system, explaining why, in his view, only conservatives were affected.

When Rogan asked, “So no one on the left gets debanked?” Andreessen replied, “I have not heard of a single instance of anyone on the left getting debanked.”

I find it frustrating when wealthy, well-connected right-wing figures portray themselves as victims instead of acknowledging their extraordinary privilege. It’s cynical, irritating, and misleading. Andreessen’s explanation of how banks assess politically exposed clients was either deeply misinformed or intentionally false.

Yet, despite my reservations, I understand some of their concerns about debanking.The reason Operation Choke Point, or Coutts bank for that matter, struggled to defend their actions is simple: their critics were correct. It is genuinely troubling that anyone can have their bank account closed simply because bankers deem them too costly or risky. Even more disturbing, however, is that the only people likely to get a fair hearing after being debanked are those who are well-connected, wealthy, or media-savvy enough to make a successful public outcry.

This is an adapted extract from Everybody Loves Our Dollars: How Money Laundering Won by Oliver Bullough, published by W&N on 29 January. Listen to our podcasts here and sign up to The Long Read weekly email here.

Frequently Asked Questions

Of course Here is a list of FAQs about the issue discussed in Access Denied The Global Trend of Muslims Losing Banking Services by Oliver Bullough

Beginner Definition Questions

1 What is derisking in banking

Derisking is when banks close accounts or deny services to entire categories of customers they perceive as highrisk to avoid potential fines or regulatory scrutiny rather than assessing individual risk

2 Who is Oliver Bullough and what is this report about

Oliver Bullough is a British journalist and author who investigates financial crime and corruption This report documents how ordinary Muslims charities and businesses around the world are being cut off from basic banking services due to banks overzealous derisking practices

3 Why are Muslims specifically affected by this

Banks often associate Muslim individuals charities sending money to family abroad and Islamic charities with higher risks of money laundering or terrorist financing To avoid complex and costly compliance checks many banks simply deny service altogether

4 Is this the same as being unbanked

Its related but different The unbanked often lack access due to poverty or remote location Here people who had accounts and services are actively having them taken away due to their religion or origin even if they are lawabiding

Impact Common Problems

5 What are the reallife consequences for individuals

People cant receive salaries pay bills get mortgages or send money to family It can destroy credit scores block business transactions and cause immense stress and financial isolation

6 How does this affect charities and nonprofits

Islamic charities especially those operating in crisis zones find their bank accounts suddenly closed This halts vital humanitarian aid as they cannot receive donations or pay for food medicine and shelter

7 Is this just about sending money abroad

No its broader While remittances are a major trigger people are also denied basic checking accounts business loans and even personal savings accounts in their home countries

8 Is this illegal discrimination

It often walks a fine line While banks cite compliance with antimoney laundering laws the blanket refusal of services based on nationality religion or geography can constitute indirect discrimination and violate